Robin Assist’s

Technology Platform

Marvin is the proprietary policy administration platform behind Robin Assist.

Designed from the ground up to meet the needs of modern travel, health, and specialty insurance providers, Marvin enables partners to build custom insurance products, launch them quickly across global markets, and manage their full policy lifecycle — with full flexibility, localization, and control.

Key Capabilities

API-First Infrastructure

Seamless integration with partner systems via secure RESTful API. Supports quoting, policy issuance, fulfilment, and management.

Global Product Configuration

Create and distribute insurance products that comply with local regulatory, language, and tax requirements.

Reporting and Analytics

Track performance, activations, expirations, and usage via real-time dashboards.

Security and Compliance

Microservice architecture, GDPR compliant, sanctions screening, access controls, and audit trails.

Integration with External Claims and Assistance Platforms

Marvin supports seamless integration with external claims and assistance case management platforms. Partners can fully customize their First Notice of Loss (FNOL) process and deliver structured claim data directly via API, guided by Marvin’s flexible rules engine.

No-Code Product Builder

Configure benefit structures, underwriting rules, and policy logic without engineering support.

Real-Time Policy Management

Modify, extend, or cancel policies through portals or APIs with audit trails.

Co-Branded Policy Issuance

Issue policies, certificates, and communications with full white-label or co-branding options.

We are SOC 2 certified

Independently verified controls for security, availability, confidentiality, and privacy.

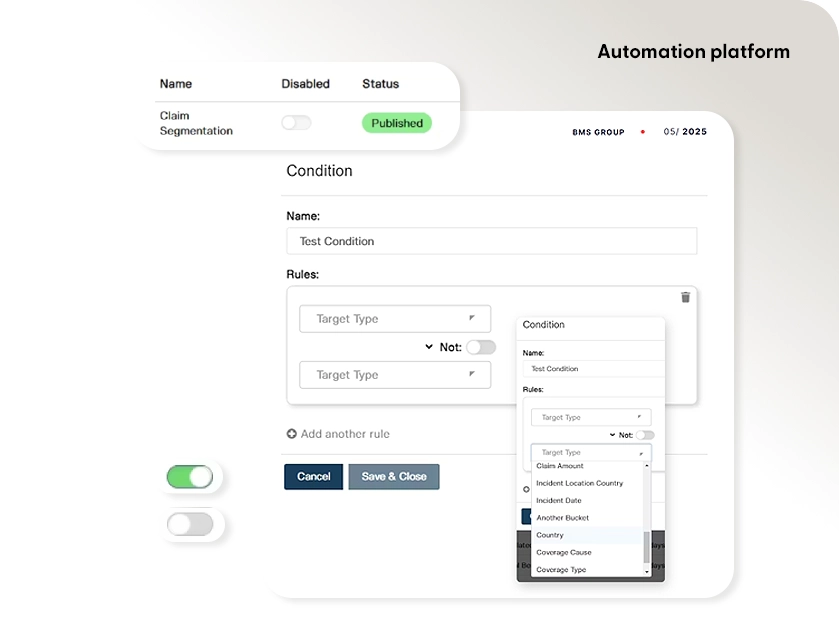

Rules Engine and Workflow Automation

Create custom workflows for FNOL triage, claims routing, escalation triggers, and document validation. Automate actions based on geography, policy logic, value thresholds, or missing information - all configurable by partner or product. Round Robin assignment, real-time alerts, and API-triggered events are supported.

How It Works

Partners use Marvin to build custom insurance products tailored to specific markets and customer segments.

Products can be embedded into existing purchase paths, offered through stand-alone portals, or integrated into broader travel and financial services distribution platforms.

Marvin handles localization, compliance, and delivery automatically and in real time.

Who Uses Marvin

Insurance carriers launching new or localized offerings

Brokers and enterprise brands creating embedded benefit programs

Travel distributors embedding insurance at point of sale

Managing general agents designing region-specific products

Use Case Example

Entering a new market

A Travel Insurance Managing General Agent (MGA) needed to enter a new market – with its own currency, language, and tax structure. Using Marvin, they built localized products, embedded them into their own purchase path, and automated document delivery.

Robin Assist also implemented a co-branded first notice of loss (FNOL) form within the partner’s website, enabling a seamless claims initiation process without disrupting the customer experience.

Marvin ensured the entire flow – from quoting to reporting – was compliant, efficient, and customer-friendly.