Fraud Detection and

Claims Intelligence

Robin Assist combines real-time AI-powered fraud document analysis with expert human judgment, targeted verification, and localized support to identify and stop fraudulent claims before they are paid.

Our approach blends smart automation with in-house assistance experience and data-driven decision-making, helping our partners reduce loss ratios and improve underwriting outcomes while protecting customers.

Key Capabilities

AI-Powered Document Forensics

Our system analyzes hundreds of technical and behavioral data points across each uploaded document - detecting signs of tampering, edits, reuse, or digital manipulation.

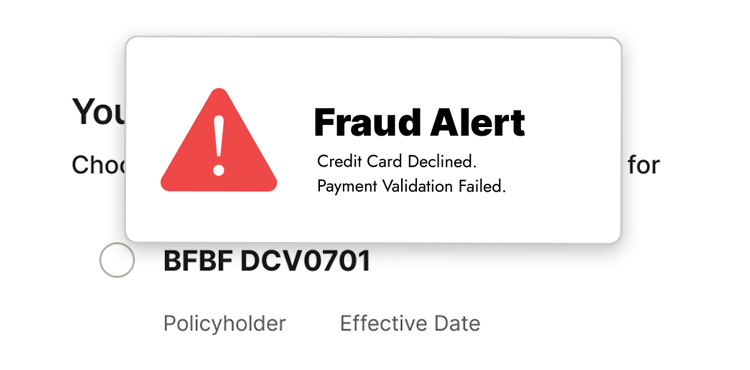

FNOL Integration with Rules Engine

When a claim is flagged for potential fraud, our rules engine automatically routes it for manual review. Our team secures further documentation and alerts partners as needed.

Medical Verification and Provider Engagement

Our 24/7 assistance team includes in-house medical experts who verify treatment details and consult with providers remotely or locally.

Identity and Location Verification

Amongst several other criteria, the rules engine also cross-checks claimant data, including factors such as claims frequency, timing of policy purchase to claim event, stated residence and loss location against policyholder records to detect inconsistencies.

Complete Audit Trail and Compliance Logging

All interactions and document actions are time-stamped and recorded to support regulatory compliance and internal review.

Embedded FNOL Document Verification

It provides real-time document validation that begins the moment a claim is submitted. Integrated into the First Notice of Loss process, this system flags potential fraud early and allows clean claims to proceed quickly while flagged claims are investigated.

Third-Party Liaison Support

As needed, we coordinate with embassies, consulates, and local law enforcement to verify pertinent documents such as incident reports.

Subrogation Identification

Claims involving third-party liability are flagged for recovery opportunities.

Use Case Example

AI-Powered Document Forensics

A claimant submitted a request for a EUR 250,000 Accidental Death and Dismemberment benefit, citing the death of their spouse in a car accident. The case was filed shortly after the reported incident, accompanied by seemingly credible documentation in French, including a police report and death certificate.

Robin Assist’s AI flagged the documents for inconsistencies in format and metadata. Our assistance team escalated the case, reaching out directly to the local police department and the national embassy. Authorities confirmed that the documents were falsified. The claim was denied before funds were disbursed, protecting our insurance carrier partner from a high-value fraud attempt.