Digital Payments

Robin Assist’s digital payment feature enables fast and reliable reimbursements to travelers and direct payments to healthcare providers and vendors in more than 140 currencies. Designed for flexibility, it can be deployed as part of our Marvin platform or as a standalone payment engine that connects to your existing claims or assistance infrastructure.

Whether your team is processing claims internally or through Robin Assist, our payment solution delivers efficient, compliant disbursements without added complexity.

Key Capabilities

Payments in 140+ currencies to providers and travellers

Same-day processing and instant payouts

Real-time payout tracking and reporting

Segregated claims accounts with partner-specific deposits, tracking and reconciliation

Optional integration with Marvin tech for a fully connected experience across assistance and claims

Payout methods include e-check, bank transfers, digital wallet, virtual prepaid cards, Venmo, PayPal and other mobile payment services

Automated currency conversion and compliance based on payment destination

Customized, and partner co-branded payee notifications

Standalone capability, allowing for integration with your existing claims platform via secure API

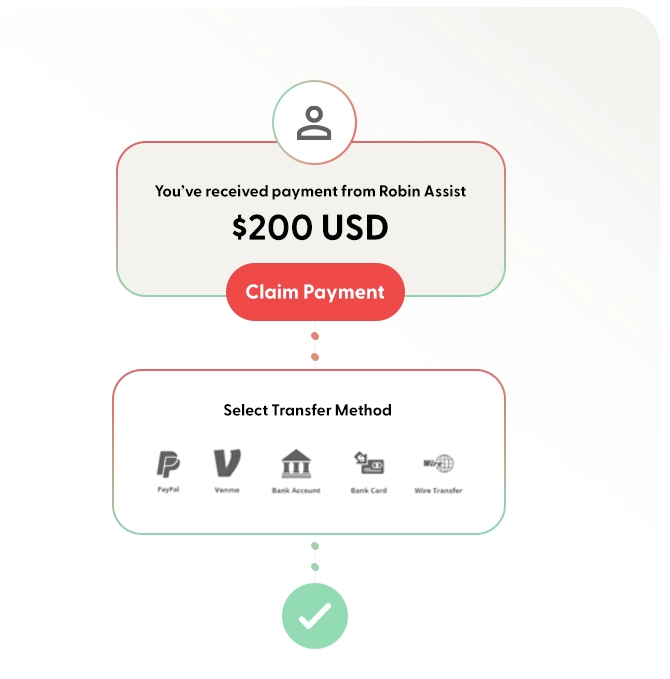

How It Works

Robin Assist Digital Payments can operate as an independent service. Partners submit a payment request through a secure interface or API connection. Robin Assist handles the disbursement, currency management, and recipient communication. Payment confirmation and tracking data are returned to the partner in real time.

Alternatively, when paired with Marvin (our internal tech platform), payments are automatically triggered at the point of claim or assistance case resolution – with no additional manual processing required.

Value to Partners

Reduces time to pay for both customers and providers

Enhanced satisfaction with fast, flexible delivery methods

Removes operational friction without disrupting existing claims infrastructure

Offers transparency, auditability, and partner-controlled account structures

Scales globally while staying locally compliant

Flexible deployment: standalone, white-labelled, co-branded or integrated

Use Case Example

Digital Wallet Functionality

A traveller required outpatient care at a private hospital in Japan. The facility would not accept a Guarantee of Payment from a foreign entity, nor would it allow credit card or wire transfer payments from outside the country – a common barrier for non-domestic insurers, third-party administrators and assistance companies.

Robin Assist resolved the issue using its Digital Wallet functionality. Within minutes of claim validation, funds were securely issued to the travelers’ mobile device through a pre-authorized, pre-determined vendor specific payout digital wallet. The traveler was able to pay the hospital directly at the point of service using tap-to-pay – avoiding any care delays or out-of-pocket stress.

This solution provided compliance with local payment restrictions, full traceability, and a seamless experience for both the traveler and the insurer.